|

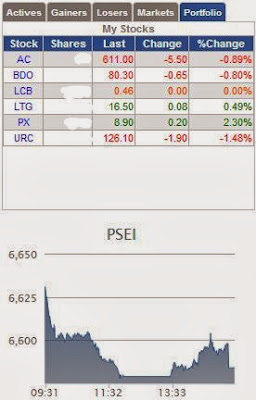

Fig. 1 AC Stock Chart

courtesy of COLFinancial |

AC is one of my long term chips. Unfortunately, AC is in the mood for selling.

Technical Analysis:

- MA (Moving Average); Price is above 50 and 200MA. Support at 200MA of 591. 200MA > 50MA, the convergence or death cross happened already so no need to push panic button.

- Candles AC is experiencing bearish candles

- Volume Low volume today <518M

- MACD (Moving Average Convergence Divergence) MACD Histo below 0 and continues to fall. Signal Line crossed MACD Line last Oct. 21 signaling a reversal. Also, MACD Line targeting centerline a negative sign for more bearish action. COL says SELL

- DMI (Directional Movement Index) at 20, no trend but Sellers are over Buyers

- RSI (Relative Strength Index) at 46, going down but may encounter support at 37

- STS (Stochastics) at 19 is at Oversold level, expect more selling in the next few days

It is not a good time to enter AC. Profit taking ongoing. Wait for entry signals especially MACD readings coinciding with STS or RSI before investing.

|

Fig. 2 BDO Stock Chart

courtesy of COLFinancial |

I have a BDO bank account. I save my money and they give me interest. But I want to become a part owner, sort of, hehe

Technical Analysis:

- MA (Moving Average); Price is above 50MA but below 200MA. It is trading sideways to bearish and it seems it looks for a higher support to previous 75. I put a bullish trendline and if right, support will be at 79ish. Resistance is at 83. Be informed that there is a gap up from 77.5 to 77.80

- Candles Bearish candles

- Volume Volume below EMA

- MACD (Moving Average Convergence Divergence) MACD Histo above 0 but tapers down. Signal Line near crossing MACD Line signaling a reversal. Not a good sign to enter

- DMI (Directional Movement Index) at 12, no trend, but the power struggle may seem to be on Sellers side as supported by MACD and STS indicators

- RSI (Relative Strength Index) at 53

- STS (Stochastics) at Oversold level, signal line crossed STS line, expect more selling in the next few days

Same as AC, It is not a good time to enter BDO. Wait for entry signals especially MACD readings coinciding with STS or RSI before investing. BDO will find ways, so don't worry.

|

Fig. 3 PX Stock Chart

courtesy of COLFinancial |

PX=Fall of Benguet, Rise of Silangan, coming 2016...

Technical Analysis:

- MA (Moving Average); Price slowly creeps up, patience to break the 9.00 50MA

- Candles Mixture

- Volume Volume below EMA

- MACD (Moving Average Convergence Divergence) MACD Histo above 0, consistent. MACD Line crossed Signal Line when SRO was cancelled, signaling a reversal. MACD Line will cross centerline anyday. Very positive.

- DMI (Directional Movement Index) at 31, upward, buyers over sellers since SRO was cancelled

- RSI (Relative Strength Index) at 54, trend upward

- STS (Stochastics) at 67, STS line still above Signal Line, expect more buying

Buy! Buy! Buy! Indicators are not lying, to Silangan it is pointing, hahaha

|

Fig. 4 PX Stock Chart

courtesy of COLFinancial |

I'm trying my third luck with LTG. All trades with LTG were supported with TA. I'm back on it again.

- MA (Moving Average); Price below 50 and 200MA. 200MA > 50MA = Death Cross, yikes last Oct. 18, now it is trading sideways

- Candles Mixture

- Volume Volume below EMA

- MACD (Moving Average Convergence Divergence) MACD Histo below 0 but "looks like" it would tapers down and go positive. Signal Line crossing MACD Line during Death Cross signaling a reversal. Is MACD trying to converge with Signal Line?

- DMI (Directional Movement Index) at 28, upward trend, but Sellers clearly over Buyers

- RSI (Relative Strength Index) at 32, is it gaining momentum

- STS (Stochastics) at Oversold level, STS line trying to converge with Signal Line, a good sign.

LTG is unclear. It does not know where to go or which side to lean on. There's a BUY signal from COLFin, +1 point. Other than that, RSI and STS is only waiting for MACD to confirm that the bulls will be in control. I have a good position on this one and cross fingers I will be right again. I'm betting on you Lagi Talagang Gain, hehe

|

Fig. 5 LCB Stock Chart

courtesy of COLFinancial |

LCB...

- MA (Moving Average); Price below 50 and 200MA. Past 2 weeks trading price at 0.44-0.46

- Candles Mixture

- Volume Volume below EMA

- MACD (Moving Average Convergence Divergence) MACD Histo above 0. MACD creeping up to centerline. Signal Line crossing MACD Line soon. Scary...

- DMI (Directional Movement Index) at 12, no trend, but Buyers over Seller but latter gaining control (seeing a convergence)

- RSI (Relative Strength Index) at 40, resistance at 47, downtrend. ouch

- STS (Stochastics) at 47, resistance at 61, downtrend, ouch ouch, STS line trying to converge with Signal Line, a bad sign.

I tried to unload today at -5% loss, but it was not sold. I will sell at strength but clearly entering LCB is a bad decision based on speculation that this is cheap and FPIC will be approved to FTAA. Lesson learned.

|

Fig. 6 URC Stock Chart

courtesy of ColFinancial |

"Kapag may inuman, isama si Mang Juan!" in salt and vinegar flavor, brought to you by URC, with branches across ASEAN, oha oha, Thailand, Myanmar and going to Indonesia...

Technical Analysis:

- MA (Moving Average); Price above 50 and 200MA check! Support at 122ish

- Candles Bearish due to profit taking, not a concern, buy on dips

- Volume Volume below EMA

- MACD (Moving Average Convergence Divergence) MACD Histo above 0, consistent. Signal Line trying to converge with MACD line, I think this is due to selling action

- DMI (Directional Movement Index) at 14, no trend, buyers over sellers but the latter is looking to cross over and change positions. beware

- RSI (Relative Strength Index) at 50, trend downard from resistance of 63

- STS (Stochastics) at 66, Signal Line crossed STS Line from Overbought levels, expect more selling

I bought URC during selldown of JGS shares for Meralco stake. A clear discount. Last week I enjoyed a 10% gain, but becuase I'm emotional, I hold on to it and did not follow the discipline of selling. But still this stock will go back and try to breach 135 resistance. I also look for opportunities to buy at dips if I sell my LCB shares.

|

Fig. 7 B2 Gold Stock Chart

courtesy of stockcharts.com |

B2 Gold experienced a price surge since Oct. 15. It was from a low of 2.21 to yesterday's closing at 2.84.

Technical Analysis:

- RSI (Relative Strength Index) at 60, continues to go up but resistance will be at 70. It hit the ceiling 2x in 6 months we'll see if it can break through

- MA (Moving Average); Price is above 50 and 200MA. A good sign indicating traders are bullish. Once 50MA > 200MA (golden cross) is achieved then it really confirms that B2 is on the right track

- Candles B2 is experiencing bullish candles, but there is an obvious gap up at 2.49 - 2.54. Beware, let's hope it fills the gap before Apr 2014, expect resistance at 2.95, support at 2.66

- Volume Obviously there is a surge in volume, bullish in particular

- MACD (Moving Average Convergence Divergence) MACD Histo above 0 and continues to rise. MACD Line crossed Signal Line on Oct 17th signaling a reversal. Also, MACD Line crossed centerline last week, a positive sign for more bullish action

- STS (Stochastics) at 95 is at Overbought level, it is a warning but other indicators are still on the rise

Overall, the change in trends from Oct 15th by all indicators provided a good indication that B2 Gold is very bullish but may reach resistance soon. Aside from that, the indicators agree with one another giving us a scenario in which we can get clues in the near future. Also, read

this. :)